1099-r with distribution code 6 in box 7 1099-R. Report military retirement pay awarded as a property settlement to a former spouse under the name and TIN of the recipient, not that of the military retiree. Use Code 7 in box 7 . What Is 5-Axis CNC Machining? This procedure involves the movement of cutting tools across five axes simultaneously. 5-axis CNC machines offer three linear axes working .

0 · irs distribution code 7 meaning

1 · irs 1099 box 7 codes

2 · form 1099 box 7 codes

3 · 1099 r minimum reporting amount

4 · 1099 r distribution codes 7d

5 · 1099 r distribution code meanings

6 · 1099 r code 7 means

7 · 1099 codes explained

In CNC, a "crash" occurs when the machine moves in such a way that is harmful to the machine, tools, or parts being machined, . See more

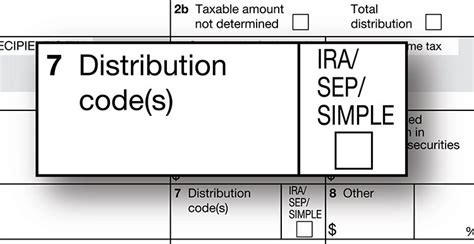

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.

If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross .1099-R. Report military retirement pay awarded as a property settlement to a former spouse under the name and TIN of the recipient, not that of the military retiree. Use Code 7 in box 7 . Use Code 6 to indicate the tax-free exchange of life insurance, annuity, long-term . One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply .

1099-R Form Retirement Distribution Codes. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R . 7 (Normal Distribution) B (Designated Roth) Code P: Corrective refunds taxable in prior year: This code indicates the monies are taxable in a prior tax year (as opposed to Code .

Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, .The following are the instructions for the 1099-R, Box 7 data entry and what each code means. that are not from an IRA, SEP, or SIMPLE are reported on Form 1040, line 1h, Other Earned .

Box 6 - Net unrealized appreciation in employer's securities shows the taxpayer received a distribution of employer's securities (stock) from a qualified pension plan. This amount is included in box 1, but not included in .

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross distribution and the appropriate code in box 7 (Code J for a Roth IRA).1099-R. Report military retirement pay awarded as a property settlement to a former spouse under the name and TIN of the recipient, not that of the military retiree. Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R.

Use Code 6 to indicate the tax-free exchange of life insurance, annuity, long-term care insurance, or endowment contracts under section 1035. One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply and explained when to use each. 1099-R Form Retirement Distribution Codes. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R and 5498. Instructions on how to enter Form 1099-R on your tax return 7 (Normal Distribution) B (Designated Roth) Code P: Corrective refunds taxable in prior year: This code indicates the monies are taxable in a prior tax year (as opposed to Code 8 with the distribution taxable the year of the 1099-R form). 1 (Early Distribution) 2 (Early Distribution—not subject to 10% early distribution tax) 4 (Death) B .

Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½).The following are the instructions for the 1099-R, Box 7 data entry and what each code means. that are not from an IRA, SEP, or SIMPLE are reported on Form 1040, line 1h, Other Earned Income. if filing Form 4972 - Lump-Sum Distribution. box. report amounts in Box 3, Capital gain on Form 8949 as "Form 1099-R Charitable Gift Annuity." box. Box 6 - Net unrealized appreciation in employer's securities shows the taxpayer received a distribution of employer's securities (stock) from a qualified pension plan. This amount is included in box 1, but not included in box 2a, and it represents the appreciation in the stock value that occurred since the original contribution of stock.The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.

If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross distribution and the appropriate code in box 7 (Code J for a Roth IRA).1099-R. Report military retirement pay awarded as a property settlement to a former spouse under the name and TIN of the recipient, not that of the military retiree. Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R.

Use Code 6 to indicate the tax-free exchange of life insurance, annuity, long-term care insurance, or endowment contracts under section 1035. One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply and explained when to use each. 1099-R Form Retirement Distribution Codes. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R and 5498. Instructions on how to enter Form 1099-R on your tax return 7 (Normal Distribution) B (Designated Roth) Code P: Corrective refunds taxable in prior year: This code indicates the monies are taxable in a prior tax year (as opposed to Code 8 with the distribution taxable the year of the 1099-R form). 1 (Early Distribution) 2 (Early Distribution—not subject to 10% early distribution tax) 4 (Death) B .

Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½).

irs distribution code 7 meaning

The following are the instructions for the 1099-R, Box 7 data entry and what each code means. that are not from an IRA, SEP, or SIMPLE are reported on Form 1040, line 1h, Other Earned Income. if filing Form 4972 - Lump-Sum Distribution. box. report amounts in Box 3, Capital gain on Form 8949 as "Form 1099-R Charitable Gift Annuity." box.

boscovs metal house fans

By your description, you're doing a dry run. It's just a term used to describe running the program through, but not cutting a part. Most machines have a "dry run" button on them, that when turned on, allow you to "rapid" through the slow feed parts of your program. It just speeds up the process of a dry run.

1099-r with distribution code 6 in box 7|1099 r minimum reporting amount