cash liquidation distribution box 8 If your client receives a cash liquidation distribution, you have to find out the basis in the stock that is being liquidated. Once the distributions exceed basis, or the final . Combine panels to make the size/shape of planter or retaining wall required. Allows 200mm size step ups. Weathering steel. Straightcurve precision-engineered Zero-Flex 560mm high weathering steel panels. > High-quality steel panels for custom raised garden bed or planter box builds. > ISO Certified Weathering steel.

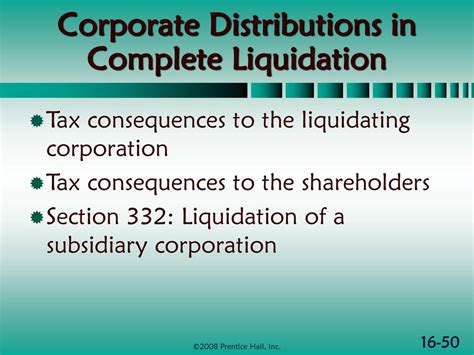

0 · tax consequences of liquidating distributions

1 · payments in lieu of dividends

2 · liquidating distribution tax treatment

3 · irs qualified dividends worksheet

4 · irs qualified dividend

5 · are liquidating dividends taxable

6 · are cash liquidation distributions taxable

7 · 1099 div nondividend distributions

Product Specifications: Material: Galvanized Steel (anti-rust), Resin lid and bottom Color: Dark Gray (infinitely close to black) Dimension: 49.41"x24.69"x23.43"(100 Gal), 49.41" x 24.69" x 27.56"(120 Gal) Storage Capacity: 100 Gallons, 120 Gallons Weight Capacity: 440 lbs Weather Resistant Storage The weatherproof resin lid effectively shields .

For payments received by a broker on behalf of a customer in lieu of dividends as a result of a loan of a customer's securities, see the instructions for box 8 under Specific Instructions for Form 1099-MISC in the current Instructions for Forms 1099-MISC and 1099-NEC. If your client receives a cash liquidation distribution, you have to find out the basis in the stock that is being liquidated. Once the distributions exceed basis, or the final . You'll receive a Form 1099-DIV from the corporation showing you the amount of the liquidating distribution in Box 8 or 9. Any liquidating distribution you receive isn't taxable to you .

adrian steel conduit box

Follow these steps to enter 1099-DIV cash or noncash liquidation distributions in the program: Go to Input Return ⮕ Income ⮕ Dispositions (Sch D, etc.). Select Schedule . Proceeds from cash liquidation distributions are reported on Form 1099-DIV. There should be an option on the Div entry screen that your 1099-Div has info in more than these .Taxable dividend distributions from life insurance contracts and employee stock ownership plans. These are reported on Form 1099-R. Understand the financial implications of cash liquidation distributions with our guide on tax treatment, accounting practices, and reporting obligations.

Box 8. This box should be left blank if a RIC reported the foreign tax shown in box 7. Boxes 9 and 10. Show cash and noncash liquidation distributions.

Box 9 Cash liquidation distributions - This amount is the cash the investor/taxpayer received upon liquidation of all or part of the underlying entity. Generally the cash distribution is considered a return of the cost or basis in . What Is a Cash Liquidation Distribution? A cash liquidation distribution, also known as a liquidating dividend, is the amount of capital returned to the investor or business owner when a.For payments received by a broker on behalf of a customer in lieu of dividends as a result of a loan of a customer's securities, see the instructions for box 8 under Specific Instructions for Form 1099-MISC in the current Instructions for Forms 1099-MISC and 1099-NEC.

If your client receives a cash liquidation distribution, you have to find out the basis in the stock that is being liquidated. Once the distributions exceed basis, or the final distribution is made so you can determine a gain or loss, you put it on Schedule D. . You'll receive a Form 1099-DIV from the corporation showing you the amount of the liquidating distribution in Box 8 or 9. Any liquidating distribution you receive isn't taxable to you until you've recovered the basis of your stock. Follow these steps to enter 1099-DIV cash or noncash liquidation distributions in the program: Go to Input Return ⮕ Income ⮕ Dispositions (Sch D, etc.). Select Schedule D/4797/etc. In the Quick Entry grid, select Details to expand. Under Dispositions (Sch D, etc.), enter the Description of Property. Proceeds from cash liquidation distributions are reported on Form 1099-DIV. There should be an option on the Div entry screen that your 1099-Div has info in more than these boxes . click that and fill in the box amount for box 8 for the amount reported.

Taxable dividend distributions from life insurance contracts and employee stock ownership plans. These are reported on Form 1099-R.

Understand the financial implications of cash liquidation distributions with our guide on tax treatment, accounting practices, and reporting obligations.Box 8. This box should be left blank if a RIC reported the foreign tax shown in box 7. Boxes 9 and 10. Show cash and noncash liquidation distributions.Box 9 Cash liquidation distributions - This amount is the cash the investor/taxpayer received upon liquidation of all or part of the underlying entity. Generally the cash distribution is considered a return of the cost or basis in the investment.

What Is a Cash Liquidation Distribution? A cash liquidation distribution, also known as a liquidating dividend, is the amount of capital returned to the investor or business owner when a.

For payments received by a broker on behalf of a customer in lieu of dividends as a result of a loan of a customer's securities, see the instructions for box 8 under Specific Instructions for Form 1099-MISC in the current Instructions for Forms 1099-MISC and 1099-NEC. If your client receives a cash liquidation distribution, you have to find out the basis in the stock that is being liquidated. Once the distributions exceed basis, or the final distribution is made so you can determine a gain or loss, you put it on Schedule D. .

You'll receive a Form 1099-DIV from the corporation showing you the amount of the liquidating distribution in Box 8 or 9. Any liquidating distribution you receive isn't taxable to you until you've recovered the basis of your stock. Follow these steps to enter 1099-DIV cash or noncash liquidation distributions in the program: Go to Input Return ⮕ Income ⮕ Dispositions (Sch D, etc.). Select Schedule D/4797/etc. In the Quick Entry grid, select Details to expand. Under Dispositions (Sch D, etc.), enter the Description of Property. Proceeds from cash liquidation distributions are reported on Form 1099-DIV. There should be an option on the Div entry screen that your 1099-Div has info in more than these boxes . click that and fill in the box amount for box 8 for the amount reported.Taxable dividend distributions from life insurance contracts and employee stock ownership plans. These are reported on Form 1099-R.

Understand the financial implications of cash liquidation distributions with our guide on tax treatment, accounting practices, and reporting obligations.Box 8. This box should be left blank if a RIC reported the foreign tax shown in box 7. Boxes 9 and 10. Show cash and noncash liquidation distributions.Box 9 Cash liquidation distributions - This amount is the cash the investor/taxpayer received upon liquidation of all or part of the underlying entity. Generally the cash distribution is considered a return of the cost or basis in the investment.

advanced roofing and sheet metal nj

tax consequences of liquidating distributions

advance sheet metal ltd

payments in lieu of dividends

liquidating distribution tax treatment

$26.99

cash liquidation distribution box 8|irs qualified dividends worksheet