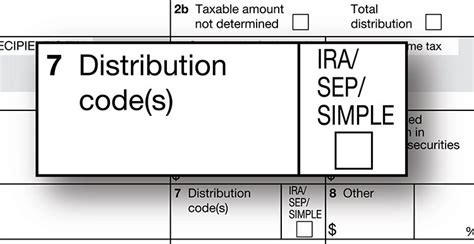

distribution code box 7 1099-r Form 1099-R Distribution Codes from Box 7. Detailed explanation. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions . What if There Is No Ground Wire In Junction Box? The NEC expects consumers to ground their electrical systems, especially if those systems supply exceeds 120V. The NEC’s rulings will keep you safe.

0 · irs distribution code 7 meaning

1 · irs 1099 box 7 codes

2 · form 1099 box 7 codes

3 · 1099 r minimum reporting amount

4 · 1099 r distribution codes 7d

5 · 1099 r distribution code meanings

6 · 1099 r code 7 means

7 · 1099 codes explained

Gold and silver have been used to embellish textiles since prehistoric times. Recently, aluminum yarns and aluminized plastic nylon strands have taken over from gold. Aluminum and cellulose acetate butyrate or mylar are the most common metal and plastic used in the metallic fabric.

If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross . Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, .

cutting thin sheet metal

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your . One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. Here’s a guide to help you choose the correct code. Form 1099-R Distribution Codes from Box 7. Detailed explanation. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions .

Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, .

cutting sheet metal with dremel tool

This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, . All of these corrections must include .Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early .The following are the instructions for the 1099-R, Box 7 data entry and what each code means. that are not from an IRA, SEP, or SIMPLE are reported on Form 1040, line 1h, Other Earned .Distributions to a domestic abuse victim. For distributions made after December 31, 2023, a distribution to a domestic abuse victim may be made from a 403(b) plan and is not subject to the 10% additional tax on early distributions.

d.e sescila military 30988 metal tool box

If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross distribution and the appropriate code in box 7 (Code J for a Roth IRA).

Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life insurance, annuity, or endowment contract and for .The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty. One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. Here’s a guide to help you choose the correct code. Form 1099-R Distribution Codes from Box 7. Detailed explanation. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R and 5498. Participant has not reached age 59 1/2, and there are no known exceptions under Code 2, 3, or 4 apply.

Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½).

This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, . All of these corrections must include applicable earnings, these are included in the 1099-R amounts.. Code A: .

Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early distribution penalty. Generally file Form 5329, however for a rollover to a traditional IRA of the entire taxable part of the distribution, do not file Form 5329;The following are the instructions for the 1099-R, Box 7 data entry and what each code means. that are not from an IRA, SEP, or SIMPLE are reported on Form 1040, line 1h, Other Earned Income. if filing Form 4972 - Lump-Sum Distribution. box. report amounts in Box 3, Capital gain on Form 8949 as "Form 1099-R Charitable Gift Annuity." box.

irs distribution code 7 meaning

irs 1099 box 7 codes

Distributions to a domestic abuse victim. For distributions made after December 31, 2023, a distribution to a domestic abuse victim may be made from a 403(b) plan and is not subject to the 10% additional tax on early distributions.If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross distribution and the appropriate code in box 7 (Code J for a Roth IRA).

Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life insurance, annuity, or endowment contract and for .

form 1099 box 7 codes

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty. One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. Here’s a guide to help you choose the correct code. Form 1099-R Distribution Codes from Box 7. Detailed explanation. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R and 5498. Participant has not reached age 59 1/2, and there are no known exceptions under Code 2, 3, or 4 apply.

Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½).

This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, . All of these corrections must include applicable earnings, these are included in the 1099-R amounts.. Code A: .Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early distribution penalty. Generally file Form 5329, however for a rollover to a traditional IRA of the entire taxable part of the distribution, do not file Form 5329;

cutting electrical boxes in brick

cutting hole in steel siding for exterior light junction box

4-axis machining introduces a new dimension of precision and versatility in CNC machining. By adding a rotary axis to the traditional X, Y, and Z axes, 4-axis CNC machines .

distribution code box 7 1099-r|irs distribution code 7 meaning