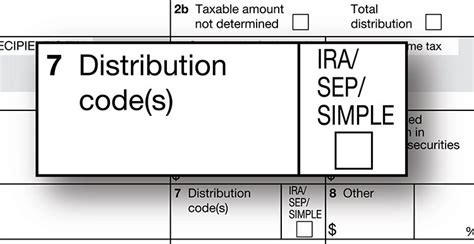

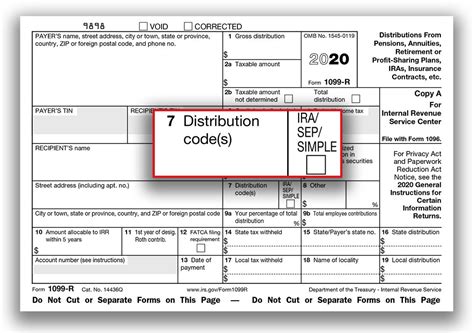

form 1099 r box 7 distribution code 2 Distribution codes in Box 7 of Form 1099-R tell the IRS what type of distribution you received. These codes indicate if the distribution is subject to early withdrawal penalties, . Our electrical enclosure boxes are UL & cUL Listed and designed to protect sensitive equipment in harsh environments, meeting and exceeding many NEMA and IP ratings. Available in a variety of sizes, styles, and materials, it’s easy to find the perfect solution for .

0 · irs distribution code 7 meaning

1 · irs 1099 distribution codes

2 · irs 1099 box 7 codes

3 · distribution code 7 normal

4 · distribution code 7 non disability

5 · 7d distribution code 1099

6 · 1099 box 7 code m

7 · 1099 4 box 7 codes

Optimize your storage with Seville Classics UltraHD Storage Cabinet. This unit is designed to optimize large spaces with a footprint of 48" wide by 24" deep by 72” high. The doors are constructed of commercial grade steel with recessed handles.

If an IRA conversion contribution or a rollover from a qualified plan is made to a Roth IRA that is later revoked or closed, and a distribution is made to the taxpayer, enter the gross distribution .The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your .

long narrow electrical enclosure

L (Deemed Distribution from Loan) P (Taxable in prior year of the 1099-R year—the year the refunded contribution was made) Code 7: Normal distribution. The distribution is after . Distribution codes in Box 7 of Form 1099-R tell the IRS what type of distribution you received. These codes indicate if the distribution is subject to early withdrawal penalties, . One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code (s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply .

Box 1 reports the total amount of distribution from a retirement plan or annuity, this is the gross amount of dollars you received from the plan. It may be taxable or not depending on many factors. Box 2 reports the taxable amount of the .

longmill cnc machine

Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, .The following are the instructions for the 1099-R, Box 7 data entry and what each code means. Codes. 8: Per IRS instructions, distributions with code. 8. that are not from an IRA, SEP, or . 1099-R Form Retirement Distribution Codes. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R . Defining 1099-R Codes. Your age dictates the 1099-R conversion code, which appears in box 7 “Distribution code(s).” If you have not yet reached age 59 1/2, your custodian will place a “2 .

locking metal lunch box

One of the most difficult aspects of reporting IRA and QRP distributions is determining the proper distribution code(s) to enter in Box 7, Distribution code(s) on IRS Form 1099-R, Distributions From Pensions, .

This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. Services; . (as opposed to Code 8 with the distribution taxable the year of the 1099-R form). 1 (Early Distribution) 2 (Early Distribution—not subject to 10% early distribution tax) . 1099-R Form Distribution Code Box 7 - G Question Hi, I rolled over 25K amount in 2023 from my 403(b) to Roth 403(b) Plan within the same employer plan. Fidelity sent me a 1099-R form with Distribution Code Box 7 - with Code G ( only one code - no second code). When I entered this information in Turbo Tax 2023, roll over tax is shown as non . Some reporting agencies put a qualifying explanation with a second code in box 7b when box 7(a) code is 2. This is because a box 2 code is that you don't have a penalty for the early distribution, but that box doesn't say why. Box 7b does give the explanation with a code. But it is not required for the issuing agency to put this information. Form 1099-R Box 7 Distribution Codes (continued) Box 7 Distribution Codes Explanations A — May be eligible for 10-year tax option This code is Out of Scope. B — Designated Roth account distribution Code B is for a distribution from a designated Roth account. This code is in scope only if taxable amount has been determined. D — Annuity .

under Rollover or Disability on Form 1099-R, and enter the amount rolled over. Trustee to trustee transfer isn’t considered a prior rollover. If more than one rollover from an IRA in . Form 1099-R Box 7 Distribution Codes (continued) Box 7 ; Distribution Codes Explanations; A — May be eligible for ; 10-year tax option; This code is Out of .

A common distribution code used in Box 7 of Form 1099-R is code 7, which indicates a normal distribution. This means that the distribution was made after the account holder reached the age of 59 and a half, and is generally not subject to early withdrawal penalties.

Usually, you should see a code 7 in box 7 on your Form 1099-R. If the distribution is for your RMD for the year, it will be treated as a normal distribution. The code 7 will be marked in Box 7 on your Form 1099-R. Besides, it will also be reported on a Form 5498 "IRA Contribution Information" where box 11 and 12 will be checked .You are not . Codes B and 2 together do not indicate a distribution from a Roth IRA, it instead indicates a distribution from a designated Roth account in a 401(k) or similar qualified retirement plan. You must answer No when TurboTax asks if the distribution was from a Roth IRA.

irs distribution code 7 meaning

irs 1099 distribution codes

More than 5,000 b. More than 2,000 c. More than 9,000 d. More than 9,000, A lump-sum distribution is reported on Form 1099-R. What is the significance of Box 7 having a code A? a. The distribution is non-taxable. b. The distribution may be eligible for the 10-year tax option method for computing the tax. c. I have a client that that has distribution code marked "2"on his 1099-R. He is 58 and retired from a company. He believes that because code 2 (where it says "exemption applies") is marked and not a 1 he should NOT pay the penalty. He used the money to buy investment property. I have read all the e.

Box 7 - Distribution code(s) shows the distribution code. See here for the meaning of the different codes. . Option 2, "Transfer 1099-R Box 2a to Form 5329, Part 1, Line 1" would be selected if the distribution is from a pension plan or IRA. In this situation, if the taxpayer did not roll over the distribution or qualify for an exemption, the .

irs 1099 box 7 codes

One of the most difficult aspects of reporting IRA and qualified retirement plan (QRP) distributions is determining the proper distribution codes to enter in Box 7, Distribution code(s), on IRS Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. Consider the following common IRA and QRP .Form . 1099-R. 2024. Cat. No. 14436Q. Distributions From Pensions, Annuities, Retirement or . 7 . Distribution code(s) IRA/ SEP/ SIMPLE. 8 . Other $ % 9a . Your percentage of total distribution % . If code C is shown in box 7, the amount shown in box 1 is a receipt of reportable Regarding the code 7 on your Form 1099-R. Does your Form 1099-R have a Code 7? Code 7 indicates a normal distribution. Code 1 indicates an early distribution from a retirement plan (except ROTH), and no exceptions apply (See list below). Code 2 indicates an early distribution (Except ROTH) and an exception applies. If you believe your Form 1099 .

A regular distribution from a Roth IRA would be reported on Form 1099-R would be reported on Form 1099-R with either code J, T or Q depending on your age, and how long you had the Roth IRA. Since the incorrect Form 1099-R had code 7, presumably you are over age 59½, so a distribution from a Roth IRA would be coded with T unless you had the .

The loan was satisfied by the offset distribution being reported with code M. Because an offset distribution is eligible for rollover, you can get the money back into a retirement account by rolling over (usually to a traditional IRA) some or all of the gross amount of the offset distribution by the due date of your 2018 tax return, including extensions.Form . 1099-R. 2024. Cat. No. 14436Q. Distributions From Pensions, Annuities, Retirement or . 7 . Distribution code(s) IRA/ SEP/ SIMPLE. 8 . Other $ % 9a . Your percentage of total distribution % . If code C is shown in box 7, the amount shown in box 1 is a receipt of reportable

Form . 1099-R. 2024. Cat. No. 14436Q. Distributions From Pensions, Annuities, Retirement or . 7 . Distribution code(s) IRA/ SEP/ SIMPLE. 8 . Other $ % 9a . Your percentage of total distribution % . If code C is shown in box 7, the amount shown in box 1 is a receipt of reportable When the Form 1099-R reporting a distribution from a traditional IRA (IRA/SEP/SIMPLE box is marked) has code 2, the Form 1099-R is typically reporting a Roth conversion. The only other reason that in 2020 code 2 might be used is if the custodian is indicating that the distribution is a Coronavirus-Related Distribution, but IRA custodians . Form 1099-R Box 7 Distribution Codes: Overview. Form 1099-R is an IRS tax form used to report distributions from pensions, annuities, retirement plans, profit-sharing plans, and IRAs.Taxpayers who receive distributions from these sources during a tax year must report the income on their tax return.

My 2016 CSA FORM 1099R box 7 Distribution Code is 2-NONDISABILITY-This does not match anything on the list. What do I do? . About form 1099-NEC; Crypto taxes; About form 1099-K; Small business taxes; Amended tax return; Capital gains tax rate; File back taxes; Find your AGI; Help and Support.

A distribution code 2 isn't entered unless the 1099-R indicates a code 1 and a code 2. Even if the taxpayer has two 1099-R from the same payer, they are each entered separately with a distribution code 1 for each 1099-R. Use code 2 only if the employee/taxpayer hasn't reached age 59 & 1/2 and you know the distribution is:Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R. Do not combine with any other codes. Governmental section 457(b) plans. Report on Form 1099-R, not Form W-2, income tax withholding and 1099-R Box 7: Distribution Code(s) This box identifies the distribution code and tells the IRS the type of distribution taken by the taxpayer. The type of distribution matters because it helps to identify whether the money from the distribution is taxable or non-taxable.

loose electrical box

locking server steel cabinet under desk

Rugged storage box features shatter-resistant polyethylene construction. Sturdy built-in handles simplify transport. Snap-on, stay-tight lids help keep contents dry and dust-free. Stackable design enables easy, space-saving storage. Boxes & Bins Type: Covered; Material (s): Low-Density Polyethylene; Color (s): Steel Gray; Number of Compartments: 1.

form 1099 r box 7 distribution code 2|distribution code 7 normal