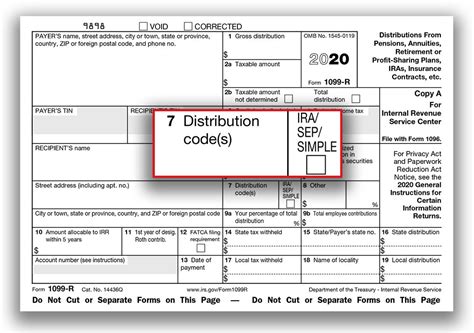

box 7 code for roth distribution If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross . Does anyone know if a 4'' octagon is the same mounting dimensions as a 4/0 mudring? In other words can I substitute a 4/0 mudring for a 4'' octagon? I don't have any boxes and rings laying around that I could compare.

0 · roth ira distribution code j

1 · irs 1099 r box 7

2 · form 1099 box 7 distribution code

3 · box 7 rollover codes

4 · box 7 ira codes

5 · box 7 1099 r meaning

6 · 457 b distribution code

7 · 1099 r box 7 distribution

What Is a Wood CNC Machine? A wood CNC machine is a type of computer-controlled tool that can cut and shape wood with high precision. Think of it like a 3D printer, but for woodworking. Instead of extruding plastic, a wood CNC machine uses a router bit or cutting tool that spins at high speeds to carve away wood in a specified pattern or design .

Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life .

Enter code B, Designated Roth account distribution, to report distributions from a designated Roth account, unless the distribution is a direct rollover to a Roth IRA or is because of a correction under the Employee Plans .

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your .Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early .If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross .Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, .

roth ira distribution code j

Use Code E for a section 415 distribution under EPCRS or Code H for a direct rollover to a Roth IRA

This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. . *Non-qualified Roth . Which distribution code should your organization use in Box 7 of IRS Form 1099-R when reporting this distribution? Enter code G, Direct rollover and direct payment, when plan participants or IRA owners directly roll over .

Designated Roth nonelective contributions and desig-nated Roth matching contributions. The SECURE 2.0 Act of 2022 permits certain nonelective contributions and matching contributions .Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life insurance, annuity, or endowment contract and for .

irs 1099 r box 7

Enter code B, Designated Roth account distribution, to report distributions from a designated Roth account, unless the distribution is a direct rollover to a Roth IRA or is because of a correction under the Employee Plans Compliance Resolution System.

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty. 1 – Early distribution (except Roth), no .Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early distribution penalty. Generally file Form 5329, however for a rollover to a traditional IRA of the entire taxable part of the distribution, do not file Form 5329;If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross distribution and the appropriate code in box 7 (Code J for a Roth IRA).Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½).

form 1099 box 7 distribution code

Use Code E for a section 415 distribution under EPCRS or Code H for a direct rollover to a Roth IRA This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. . *Non-qualified Roth Distribution (less than 5 years) – use code B and complete Box 11 (Roth clock start), the principal Roth contribution amount in Box 10, and the taxable amount in .

Which distribution code should your organization use in Box 7 of IRS Form 1099-R when reporting this distribution? Enter code G, Direct rollover and direct payment, when plan participants or IRA owners directly roll over non-Roth QRP or IRA assets to an eligible employer-sponsored retirement plan.Designated Roth nonelective contributions and desig-nated Roth matching contributions. The SECURE 2.0 Act of 2022 permits certain nonelective contributions and matching contributions that are made after December 29, 2022, to be designated as Roth contributions. Distributions for emergency personal expenses.

Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life insurance, annuity, or endowment contract and for .

Enter code B, Designated Roth account distribution, to report distributions from a designated Roth account, unless the distribution is a direct rollover to a Roth IRA or is because of a correction under the Employee Plans Compliance Resolution System.The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty. 1 – Early distribution (except Roth), no .Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early distribution penalty. Generally file Form 5329, however for a rollover to a traditional IRA of the entire taxable part of the distribution, do not file Form 5329;If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross distribution and the appropriate code in box 7 (Code J for a Roth IRA).

Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½). Use Code E for a section 415 distribution under EPCRS or Code H for a direct rollover to a Roth IRA This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. . *Non-qualified Roth Distribution (less than 5 years) – use code B and complete Box 11 (Roth clock start), the principal Roth contribution amount in Box 10, and the taxable amount in . Which distribution code should your organization use in Box 7 of IRS Form 1099-R when reporting this distribution? Enter code G, Direct rollover and direct payment, when plan participants or IRA owners directly roll over non-Roth QRP or IRA assets to an eligible employer-sponsored retirement plan.

box 7 rollover codes

box 7 ira codes

box 7 1099 r meaning

What is a Box Spring? A box spring is the same size and shape as a mattress. However, unlike a mattress, a box spring is made with a solid wooden frame. Within the frame, .

box 7 code for roth distribution|roth ira distribution code j