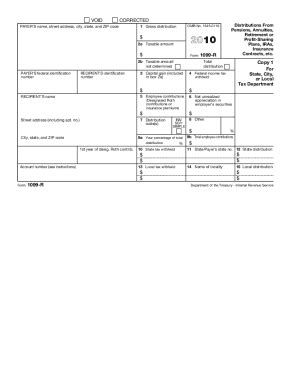

total distribution box on 1099 r If you are reporting a total distribution from a plan that includes a distribution of DVECs, you may file a separate Form 1099-R to report the distribution of DVECs. If you do, report the distribution of DVECs in boxes 1 and 2a on the separate Form 1099-R. Metal fabrication—the process of transforming raw metal materials into finished products—is a cornerstone in the world of manufacturing. This intricate craft combines skill, technology, and invention and plays a key role in shaping the infrastructure of .

0 · what is a 1099 r for tax purposes

1 · 1099 taxable amount not determined

2 · 1099 r profit sharing plan

3 · 1099 r gross distribution meaning

4 · 1099 r exemptions list

5 · 1099 r distribution from pension

6 · 1099 r boxes explained

7 · 1099 r 2a taxable amount

The home telephone wiring junction box serves as a central connection point for all the telephone lines in your house. It is a crucial component of your home’s telephone network, allowing you to connect multiple devices to the phone line, .

If you are reporting a total distribution from a plan that includes a distribution of DVECs, you may file a separate Form 1099-R to report the distribution of DVECs. If you do, report the distribution of DVECs in boxes 1 and 2a on the separate Form 1099-R.

File Form 1099-R for each person to whom you have made a designated distribution .

Box 9a, percent of total distribution, is generally used when a 1099-R distribution is split between more than one person. This is unusual, and if it was empty on the form you . Box 1 - Gross Distribution shows the total or gross amount that was distributed to the taxpayer this year. The amount may have been a direct rollover, a transfer or conversion to a Roth IRA. It also may have been received as a . If you received a distribution of or more from your retirement plan, you should receive a copy of Form 1099-R, Form CSA 1099R, Form CSF 1099R, or Form RRB-1099-R. Pre-tax contributions to pension and annuity .File Form 1099-R for each person to whom you have made a designated distribution or are treated as having made a distribution of or more from: Profit-sharing or retirement plans. .

what is a 1099 r for tax purposes

1099-R Box 2: Gross Distribution. This box is significant because it identifies the taxable amount of a distribution that’s reported by the payer. The annuity or retirement plan determines the amount to include. As the payer, you’ll report .

What is Form 1099-R? Form 1099-R is an IRS tax form used to report income received from: Retirement plans, such as a 401 (k) IRA. Pensions. Profit-sharing plans. . The total distribution amount is shown in Box 1, indicating the total amount of money you received from your retirement plan during the tax year. Box 2 specifies the taxable amount of the.

Distribution codes in Box 7 of Form 1099-R tell the IRS what type of distribution you received. These codes indicate if the distribution is subject to early withdrawal penalties, exempt from penalties, or rolled over into another .I filed my brother's taxes online and forgot to check the box that says that the rollover amount was the total distribution on his 1099-r. Will that cause a problem with the IRS? The rest of the information is correct. Gross Distribution, Taxable Amount The client contributed k on 12/3/2021 and withdrew the funds on 12/10/2021. Fidelity issued him a 1099-R for 6 cents earnings in the 7 days. If I report on the Additional Distribution Information page of the 1099-R worksheet by checking box A4 the k gets included in income. If I check the box on B1 the k does not show up in income., and Code G - Direct Rollover.

1099 taxable amount not determined

On form 1099-R, 2b, if the total distribution box has an X in it does this also mean that in 2b the taxable amount is not determined? No, the Taxable amount not determined checkbox is entirely separate from the Total distribution checkbox. June 6, 2019 1:23 AM. 0 941 Reply. Bookmark Icon. Still have questions? Make a post.

Help with 1099-R please. Box 2a (taxable amount) is blank. Box 2b (taxable amount not determined) is checked and so is “Total Distribution”. Unsolved My son had a small Roth IRA that he cashed out. Distribution was only a few hundred dollars. Federal tax was withheld at the time but when he’s trying to file his taxes, it’s flagging . Box 1 - Gross Distribution shows the total or gross amount that was distributed to the taxpayer this year. The amount may have been a direct rollover, a transfer or conversion to a Roth IRA. It also may have been received as a periodic payment, a non-periodic payment, or as a total distribution. . Option 2, "Transfer 1099-R Box 2a to Form . Solved: I just retired in 2022. I got a 1099-R which includes 4 months of normal distribution including money to me plus fed and state tax withholding. It also. US En . Box 5a will show the total distribution. Box 5b will show the taxable portion. To return to the entry screens press Back on the sidebar. Some key numbers on your 1040 tax . Box 9a, percent of total distribution, is generally used when a 1099-R distribution is split between more than one person. This is unusual, and if it was empty on the form you received you can leave it blank in TurboTax. Option 1. You should leave box 9a blank in TurboTax if that section is blank/missing on your 1099-R. Click in the box and hit .

1099 r profit sharing plan

I received a 1099-R with Box 7 coded as 4D which is correct it is for an Inherited Annuity Total Distribution. In Federal it asks Where is this Distribution From? Select the Source of this Distribution. I select "None of the above" because it is .1099-R. 2024. Cat. No. 14436Q. Distributions From Pensions, Annuities, Retirement or . Box 1. Shows the total amount distributed this year. The amount may have been a direct rollover, a transfer or conversion to a Roth IRA, a . If this is a total distribution from a qualified plan and you were born . 2— .

Solved: Hello, on my Form 1099-R the box 9a (Your percentage of total distribution) is left blank. So I enter 0 but TurboTax requires a value of at least 0.01.1099-R reports only when money comes out. If you did both actions in 2021, you should receive one 1099-R for 401k plan, and another 1099-R for IRA. They go to different lines on 1040. Line 4a IRA distribution gross amount is the amount that came out of your traditional IRA. 4b is the taxable amount that came out of your traditional IRA.

If an annuity contract is part of a multiple recipient lump-sum distribution, Box 8 should contain, along with the current actuarial value, the percentage of the total annuity contract each Form 1099-R represents. Box 8 should also contain the amount of the reduction in the investment against the cash value of an annuity contract or the cash .

Turbotax is asking for my percentage of total distribution when the 1099r is blank. . Your percentage of total distribution. Zero is not allowed. The box must be blank. (Box 9a is only used if the box 1 amount was split between 2 or more payees and tells you what your share is. A "0" (zero) would indicate that the 1099-R is reporting your . The program form has a checkbox for indicating that the distribution reported on this Form 1099-R is from an IRA/SIMPLE/SEP retirement account. The checkbox is not associated with the dropdowns for box 7. Does your Form 1099-R have that IRA/SIMPLE/SEP box checked? The gross distribution is the 1099-R box 1and taxable amount is box 2a. Is box 2a actually more then box 1 on your 1099-R? The taxable amount is what part of box 1 is taxable, it can never be more than the total of box 1. **Disclaimer: This post is for discussion purposes only and is NOT tax advice. The author takes no responsibility for the . On my 1099 R it asks for percentage of total distribution. it says 0% on my box in 1099, but it wont let me enter anything less than .01 in turbotax?? 2 When TurboTax imports the data from a picture of a 1099-r form TURBO tax inputs a "0" in the field.

Put it simple i put in that i paid 109 in taxes for the distribution on the 1099-r but after the walk though it tells me i owe 109 in additional taxes but i have already paid the 109. why would i need to pay 20% for this distribution.. . that is a total of ,270.19 (30%) . (including box 4 on your 1099-R) and puts all your withholding on .Code G means you took a distribution from a retirement account but it was immediately (by the trustee) rolled into another qualified retirement account. So when you move a 401k from an old job to an IRA or new job's retirement plan. Is the "taxable amount" (box 2a) on the 1099 equal to How to continue with 1099-R box 2b, total distribution box is not checked and should not be checked as it is not a total distribution? Please try checking and unchecking the boxes in 2b and see if you can continue. If the first box in 2b "Taxable amount not determined" is checked, the payer was unable to determine the taxable amount and box 2a . or empty? If so, there's no tax impact from this rollover. Hello, on my Form 1099-R the box 9a (Your percentage of total distribution) is left blank. So I enter 0 but TurboTax requires a value of at least 0.01. So, wat do? . Hello, on my Form 1099-R the box 9a (Your percentage of total distribution) is left blank. So I enter 0 but TurboTax requires a value of at least 0.01. I have a 1099-R with a value of "0 %" in box 9a: "Your percentage of total distribution". TurboTax says the minimum value is 0.01. How should I enter this form?

1099 r gross distribution meaning

Scroll down to Line 4, where you should see that your total distribution and the taxable amount will show on 4a/4b (or 4c/4d). . Box 1 of the 1099-R (Gross distribution) should be posted to Box 4a or 5a of your 1040, which represents the full distribution. Box 2a of the 1099-R (Taxable Amount) should be posted to Box 4b or 5b of your 1040 .B and 2 are two separate codes and must be entered individually in the two drop-down boxes on TurboTax's 1099-R form. Codes B and 2 together mean that the distribution was from a Designated Roth Account in a qualified retirement plan (B) but is not subject to an early-distribution penalty despite you having been under age 59½ at the time of the distribution (2).

Regardless of whether or not your 1099-R has the checkbox, you should check it on the TT screen since that tells TT that you left box 2a blank on purpose. Based on your answers to all of the program's questions TT will compute the "box 2a" taxable amount and transfer it to the 1040 or 1040A. You don't need to attempt to calculate the taxable .

1099-R Percentage of Total Distribution I received a 1099-R from my late fathers life insurance. . Box 7 has a code of 4 and D. I thought it was the death benefit from a life insurance policy. I entered everything on the form, and it is showing the entire 100% as taxable income on my 1040. April 13, 2023 3:41 PM. 1099-R from OPM if box 2 is blank or state unknown you have to put in the same amount that is in box 1 into box 2 in order for the pension or annuity to be taxed properly. Leaving box 2 blank will not tax the full amount that is listed in box 1 .The 2023 1099-R shows: Box 1: ,500 Box 2a:

Box 7: Distribution code G IRA / SEP / SIMPLE: X All of my prior conversions read: Box 1: Conversion amount Box 2a: Conversion amount Box 2b: Taxable amount not determined, total distribution both checked Box 7: Code 2 IRA / SEP / SIMPLE: X

1099 r exemptions list

1099 r distribution from pension

Metal barn stars are an element of Americana that has decorated the outside of barns and homes since the 1700s. Whether a barn or hex star, the shape, colors and materials have symbolic meanings for various rural .

total distribution box on 1099 r|1099 r 2a taxable amount